While cloud is now established as the gateway to the future health of financial services organizations, it comes with a host of challenges very specific to the sector.

Successful cloud adoption is built on a thoughtful roadmap of a wide range of factors such as budget, talent, skillset, the economy, security concerns, and regulatory compliance etc.

Banks and other financial services organizations hold increasing amounts of data in the cloud. According to Celent’s Technology Insight and Strategy Survey 2023*, 70% of retail banks plan to move more of their business-critical workloads to the cloud in the next 18 months. Yet many find the expected benefits such as cost-efficiency, better agility, and enhanced security are slow to materialize. For some, cloud adoption has created new challenges surrounding cost management, security, and compliance which are hard to resolve.

The simple truth is that being in the cloud does not automatically transform an organization or prime it for digital success. These things take careful planning, skilful engineering, and new ways of working. Companies that invest in strong foundations unlock cloud capabilities more quickly and avoid a whole host of potential pitfalls.

Areas which typically benefit from expert attention include cost management, security, and governance. Maximising agility and innovation in the cloud is also reliant on cloud-native tools and processes which require skilful implementation. Another key consideration is environmental sustainability, and this demands purposeful steps to reduce the carbon footprint of cloud resources.

Whether a company is going all-in with cloud or adopting a hybrid model, it's important to address the above factors to ensure cloud environments are set up to deliver the intended outcomes . This is especially true for financial services companies, which must operate with care and integrity in a competitive market .

So how can the various requirements be satisfied to maximize value in the cloud?

Recognize That ‘Doing What You Did’ Won’t Deliver Value

A major barrier to cloud success is the replication of traditional processes, frameworks, and attitudes from the on-premises mindset . Legacy architectures and ways of working tend to be too rigid to make the most of cloud’s dynamism and scalability. This leads to inefficiency, which quickly equates to wasted resources and can also expose the organization to risk.

Modern, cloud-native approaches help avoid these issues and make cloud transformation vision a reality.

Take cost reduction, a primary driver of many financial services cloud adoption strategies. It’s often assumed that cloud’s operational expenditure model will naturally deliver savings but spend may go up instead of down. Inadequate cost management is usually behind the problem. This can be addressed through various technical approaches, from optimizing server architectures via autoscaling and rightsizing to adopting container technology to moving to a serverless model. There is no single ‘right way’ so advantages and disadvantages must be assessed on a case-by-case basis.

The goal is to minimize waste by taking full advantage of the ability to expand and contract cloud infrastructure according to need. Ensuring you only use what you need when you need it facilitates a tighter rein on spend . Yet when there is limited cloud engineering expertise within the organization opportunities for on-demand variable access may be missed. This is where the benefits of an experienced cloud partner with deep platform knowledge and a close relationship with the cloud provider come to the fore.

It’s a similar story for cloud security, compliance, and resilience. All these vital aspects of financial services operations can be augmented to meet or exceed company and regulatory standards. However, financial services companies must navigate a new landscape of challenges and competencies. For instance, the shared responsibility model of cloud computing requires a clear understanding of what security aspects are managed by the provider and what is the responsibility of the company. Switching to this model can lead to gaps in security unless cloud-specific protocols are implemented and maintained.

Focus on People, Not Just Technology and Processes

Limited cloud knowledge is a risk factor for any organization undergoing transformation, but it is especially acute for financial services companies. Lack of experience and expertise in cloud technology can lead to a reliance on approaches and strategies that are not suitable in a highly regulated sector.

Decentralized, workload-specific cloud adoption is a case in point. It often results in repetitive manual actions and a lack of consistent enforcement of compliance measures. As more workloads are hosted on the cloud, inefficiencies and complexities escalate, making it harder to manage cloud environments.

This can be avoided or mitigated with a centralized approach where key individuals set policies and goals to improve cloud outcomes and manage risks. While they all receive cloud training, they don’t necessarily have to be cloud experts. In fact, it’s often better if they represent various aspects of the organization. Their role is to steer the strategy, ensuring matters like security, compliance, and total cost of ownership are properly addressed.

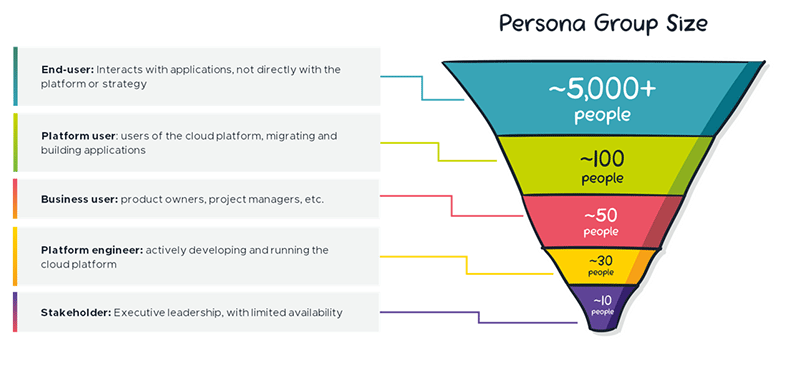

Deriving value from cloud also requires a fundamental shift in the way people function on a day-to-day basis across the entire organization. Education and training have a vital role to play here. Needs vary according to individuals’ roles and the way they will interact with cloud resources, as the below diagram indicates.

Embedding these new skills and approaches takes time, which is why many financial services organizations choose to partner with a cloud consultancy during transformation. The best partners bring more than cloud and sector-specific expertise. They also put knowledge transfer at the heart of the engagement, gradually handing responsibility to in-house teams as their confidence and competence grows.

Apply the Right Expertise to Pin Down the Best Approaches

Identifying and implementing measures to deliver value in the cloud demands deep understanding of cloud-native approaches, company insights, and sector knowledge. However, experienced cloud professionals are at a premium and few companies hold the necessary balance of capability and capacity in-house to ensure transformation delivers. Expert input from a specialist partner that brings a proven track record empowering and enabling financial services organizations in the cloud can make all the difference.

Reimagine your Business for Today and Tomorrow with AWS

AWS is a pioneer at the intersection of financial services and technology, enabling customers to optimize operations and accelerate innovation through the broadest set of services and partner solutions, all while adapting to ever-changing regulations. Thousands of financial services firms, from the fastest-growing fintechs to systemically important financial institutions, are redefining their future on AWS.

Banks on AWS can accelerate and enhance processes across the value chain with artificial intelligence and automation. It’s also easy to launch new capabilities through core systems modernization. With AWS, banks can drive revenue growth, elevate banking experiences, reduce costs, and confidently adapt to regulatory and security requirements.

Amdocs Helps Financial Services Companies Achieve More

Experienced consultants and engineers at Amdocs have helped many financial services companies derive tangible business value from their cloud investment. We understand the rigors and complexities of the market, and collaborate with client teams to overcome challenges, release benefits, and deliver target outcomes. Furthermore, we have developed and tested pioneering approaches such as Value-led Modernization at Scale. This advanced toolset allows large enterprises to combine cloud adoption with application modernization using automation and machine learning to unlock cloud value. Amdocs has a longstanding relationship with AWS, and our dedicated cloud consultancy Sourced Group is an AWS Premier Consulting Partner holding various accreditations including the Financial Services Competency.